How to Read My Special Credit Report

Many special credit reports are riddled with errors and mistakes. Sometimes, there are mixed files or outright identity theft. Experts estimate than as many as 25% of credit reports have errors or mistakes big enough to change a credit score.

To ensure your credit file is clean and correct, you should closely review the reports you received. If you find inaccuracies in your report, you should file a dispute with the special credit reporting company immediately.

What’s in My Special Credit Report?

Every special credit reporting agency provides their reports in slightly different formats. Generally, there are two types of information on special credit reports: (1) personal information; and (2) account information (also called “trade-line” information).

Special credit reporting agencies must “clearly and accurately disclose” all information required by law, including, but not limited to: all information in the consumer’s file; the sources of the information; and identification of each person (including each end-user) that procured a consumer report.

Sometimes reports can be as short as a single page, whereas others can be hundreds of pages long. Occasionally, a special reporting company just doesn’t have any information about you. In that case, you’ll get a so-called “blank file” response. If no such credit file exists, the special credit reporting agency is obligated to certify that it has made a reasonably diligent search of its available business records and that the records requested do not exist or are not reasonably available.

You should also note that the law limits the length of time that information can be reported on your special credit report. Seven years is the maximum age for information and accounts to appear on your report. So, information and accounts older than 7 years must be removed.

Sample Special Credit Reports

We have posted samples of a few anonymized special credit reports.

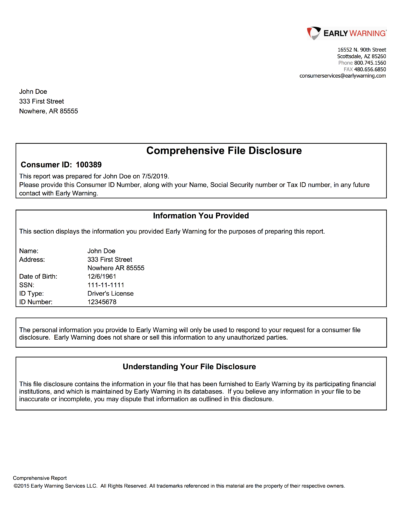

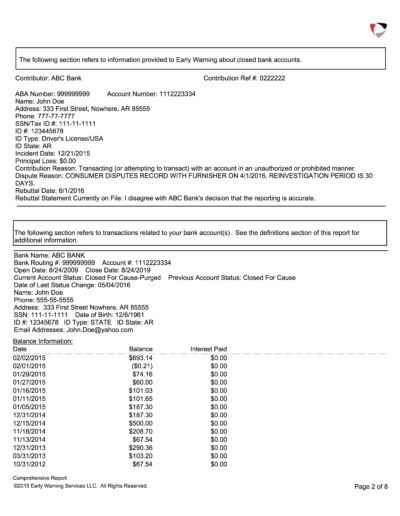

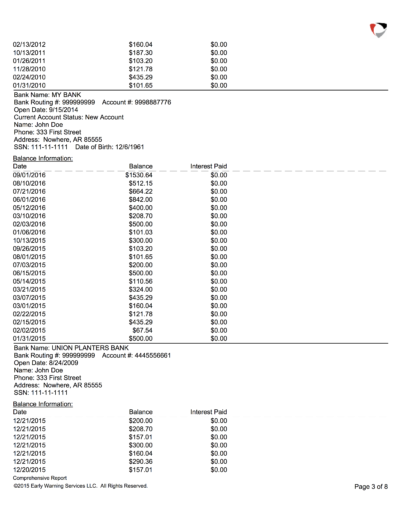

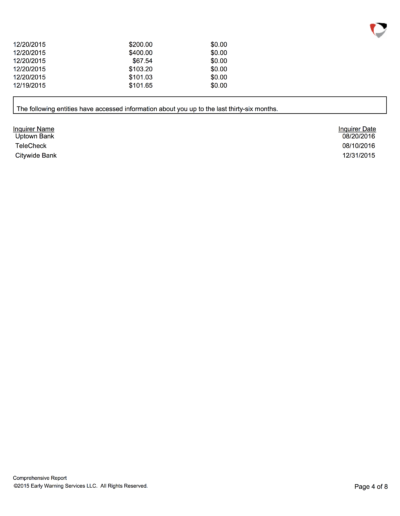

(1) Sample Report – Early Warning Services – Banking and Checking History

This is a sample special credit report from Early Warning Services. Banking and financial institutions use the credit report from Early Warning Services to evaluate and assess bank customers.

The information on the special credit report from Early Warning Services includes: full name; address; date of birth; social security number; name of all banks where you have an account; your bank account number(s); your bank account balances; and the status of your accounts.

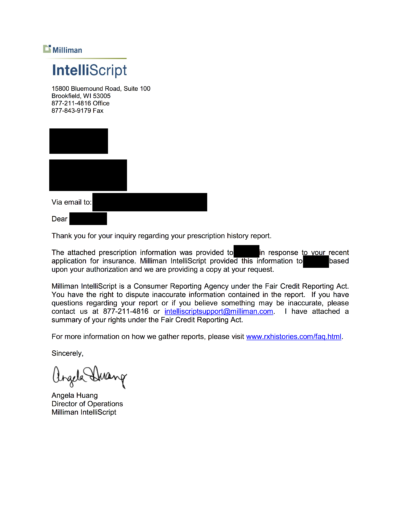

(2) Sample Report – Milliman IntelliScript – Prescription and Medical History

This is a sample special credit report from Milliman. Insurance companies use the IntelliScript credit report product from Milliman to evaluate and assess the health of insurance customers.

The information on the special credit report from Milliman includes: full name; address; date of birth; social security number; age; gender; prescription history; drug generic game; drug brand name; physician; filling pharmacy; prescription fill date; quantity prescribed; and prescription refill amount.

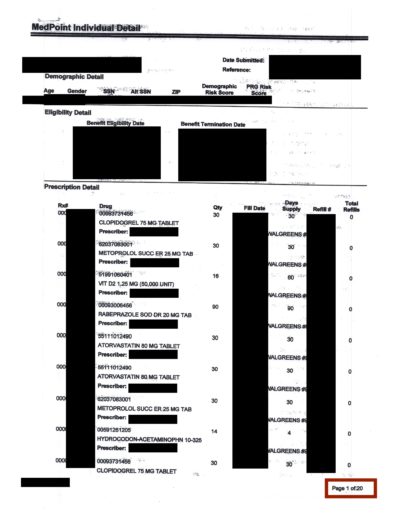

(3) Sample Report – Quest Diagnostics/ ExamOne ScriptCheck – Prescription and Medical History

This is a sample special credit report from Quest Diagnostics/ ExamOne. Insurance companies use the ScriptCheck credit report product from Quest Diagnostics/ ExamOne to evaluate and assess the health of insurance customers.

The information on the special credit report from Quest Diagnostics/ ExamOne includes: full name; address; date of birth; social security number; age; gender; demographic risk score; benefit eligibility dates; prescription history; drug generic game; drug brand name; physician; filling pharmacy; prescription fill date; quantity prescribed; and prescription refill amount

If you find inaccurate or incorrect information in your special credit report, you should dispute it immediately. For more resources on disputing, see our guide, How to Dispute Inaccurate Information on My Special Credit Report.

And finally, if you’d like to anonymously share your special credit report in the name of ‘science’, contact us.