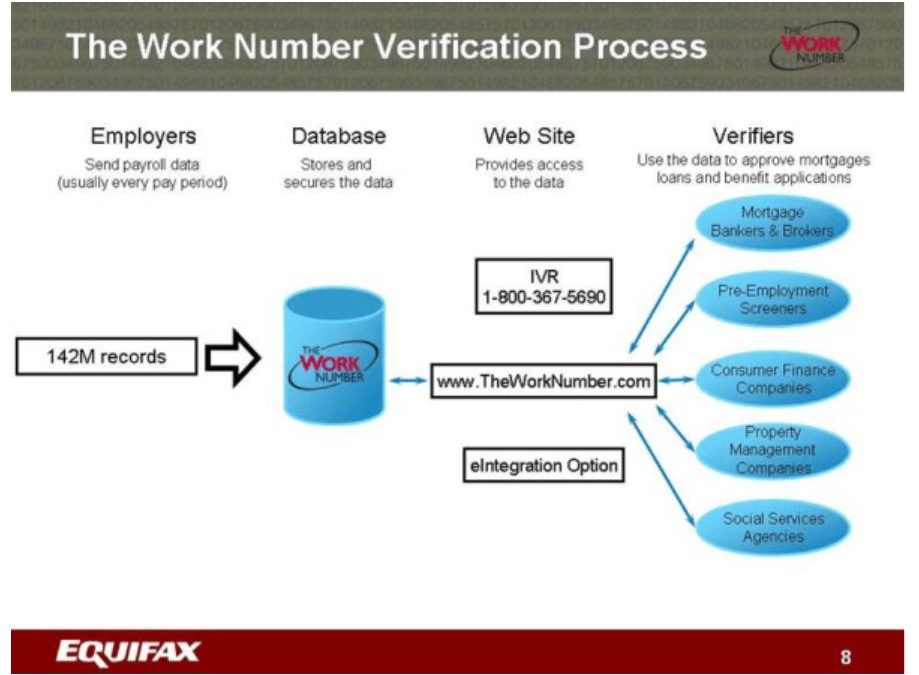

Equifax is made up of many credit reporting agencies. The most famous Equifax credit reporting agency that sells personal financial information is the one that recently suffered one of the most highly publicized and highly sensitive data breaches in history, impacting 145 million identities. The second largest Equifax credit reporting agency, Equifax Workforce Solutions, is the one that has 296 million employment records that represent, according to the company, “approximately one-third of the working population in the United States.”

It may be even more than that. On a regular basis, a wide range of employers send employment and salary data about their employees to Equifax, including 75% of the country’s Fortune 500 companies, 85% of the federal government workforce, entire state governments and agencies, courts, colleges, and thousands of small businesses nationwide. Financial companies such as mortgage servicers, debt collectors, student lenders, and credit card companies then buy this salary data in the form of individual credit reports. Likewise, prospective employers buy salary data and work history reports about job applicants. Prior to his departure, Equifax’s former CEO Rick Smith estimated that the workforce division “is worth about $9 billion.”

The Work Number database, as it’s known, is also valuable to hackers and fraudsters. As Fast Company previously reported, Equifax Workforce Solutions acknowledged another data theft, separate from the larger hack. For nearly a year, Equifax said in May, criminals had gained unauthorized access to W-2 tax data for an unknown number of employees at various companies, including defense giant Northrup Grumman, staffing firm Allegis Group, and the University of Louisville.

In an email to Fast Company, the credit agency said it still did not know the exact extent of the damage wrought by the breach, but that it “do[es] not know of any specific fraud incidents linked with the Work Number.” On October 8, 2017, after security expert Brian Krebs blogged about another security flaw in the Work Number’s consumer application portal, Equifax took it offline for maintenance; it reopened it on November 3 with additional security measures.

There is no way to opt out of being included in the Work Number database, but, it turns out, it is possible to prevent others from requesting your individual employment credit report to begin with. Equifax, however, doesn’t explicitly explain how to activate additional privacy protections on salary reports, or even publicize such privacy options. In an email to Fast Company, spokesperson Marisa Salcines explained, “Freeze requests are uncommon, so we don’t have any specific freeze instructions on our website.”

HOW TO ASK EQUIFAX TO PROTECT YOUR SALARY DATA

The first privacy option Equifax offers individuals is a credit “Alert,” which requires that you be contacted before a credentialed verifier, such as a mortgage or credit card company, opens a new line of credit or extends existing credit to you. “This is most frequently used by active-duty military or by individuals who believe they may have been a victim of identity theft-related fraud,” writes Salcines.

The second, and stronger privacy option, the credit “Freeze,” is a legal request to restrict others’ access to your individual salary history report. When a verifier requests a “frozen” record, it will see a “no record” response.

There is no charge for an individual to “Freeze” or “Unfreeze” their Equifax Workforce Solutions report.

There are three ways you can request a credit “Alert” or “Freeze” of your Equifax Workforce Solutions report:

- Call Equifax Workforce Solutions at 866-222-5880 to make an action request (either Alert or Freeze) and provide identity verification.

- Mail an action request (either Alert or Freeze) and proof of identity to: Equifax Workforce Solutions, ATTN: DISPUTE. 3470 Rider Trail South, Earth City, MO 63045.

- Fax an action request (either Alert or Freeze) and proof of identity to: Equifax Workforce Solutions at (314) 812-6822.

Once the freeze action is complete, usually by the next business day, according to Equifax, you’ll receive a notification with a case number and instructions on how to remove the freeze.

Keep in mind that when conducting any credit- or employment-related transaction that requires Equifax Workforce Solutions verification, you must contact Equifax to “unfreeze” your record, writes Salcines. “Like with a credit freeze, it is incumbent upon the employee to remember to lift the freeze prior to undertaking any credit- or employment-related transaction, as it may create an obstacle to receiving the credit or benefit the employee is seeking.”

HOW TO REVIEW—AND DISPUTE—YOUR SALARY DATA

In accordance with federal law, Equifax allows you to see your salary history report and all the lenders, credit agencies, and other verifiers who have requested it over the past five years. You can get your free “Employment Data Report” once a year by filling out a form at the Equifax Workforce Solutions website, or by making a request by mail, using this form and the address provided, or through a toll-free phone number, 866-604-6570. Note that others may also have your employment data: The Consumer Financial Protection Bureau estimates there are at least 400 other specialty consumer reporting agencies operating in the U.S., with dozens focused on employment screening.

The company also provides a way for consumers to, at any time, dispute an item on his or her salary history credit report by phone, mail, or online—assuming that the consumer notices an error to begin with. It’s not clear how widespread such errors are, but a nationwide study by the Federal Trade Commission in 2012 confirmed errors on at least 20% of the consumer credit reports it chose at random. In 2015, Equifax and the other two giant credit reporting firms, Experian and Transunion, signed a $6 million settlement with 30 states promising to do a better job investigating and resolving consumer complaints.

REQUESTING AND FREEZING YOUR CREDIT DATA

Be aware that the Equifax Work Number specialty salary history report is not the same as Equifax’s free annual credit report, which is available at AnnualCreditReport.com. If you want to freeze your credit report data—which can make it nearly impossible for hackers to open new accounts in your name—you can do so through this online form. Since the massive breach that impacted 145 million identities, Equifax has said it is waiving any fee to place, temporarily lift, or permanently remove a security freeze on credit reports through January 31, 2018. (The two other major credit reporting agencies, Experian and TransUnion, also offer security freezes through their websites.)

Meanwhile, investigations into the massive breach remain active. In addition to over 240 individual class-action lawsuits and a rare 50-state class-action lawsuit, Equifax is now the subject of an investigation by the Federal Trade Commission, more than 60 government investigations from U.S. state attorneys general, federal agencies, and the British and Canadian governments.

The article “Equifax Could Be Selling Your Salary History. Here’s How to Protect It.” originally appeared in Fast Company.